SCAL Chief Underwriting Officer, Mr Uari Oaveta (seated in the middle in the photo above) leads a young, friendly and confident team ready to promptly attend to all insurance requests and inquiries.

We aim to make insurance easy for your understand and appreciate, so that you can give your fullest efforts to the opportunities that are present in Papua New Guinea. These opportunities come in different forms such as your personal assets, your small business, or if you are in charge of a major corporation. It is important that this growth opportunities must be secured by reliable, timely and effective insurance underwriting that is specific to each client.

Underwriting is about evaluating the risk and exposures of assets that clients intend to insure. It is the most important process in an insurance company. Every Insurer has their own set of underwriting guidelines to enable the underwriters to determine whether the Insurer should accept the risks or not.

SCAL’s objective is to offer affordable and effective insurance cover and set a high standard for customer service, hence our approach is to rigorously assess the risk information provided by clients so that the insurance policy can be proportionately underwritten and be maintained in a timely manner. The SCAL underwriting team works very closely with the Risk Survey team to physically inspect and survey clients’ properties and make recommendations to minimize potential losses, and also the Service Center team to ensure make sure all policy information is accurately entered and updated in the insurance software system.

Underwriting and claims performance history

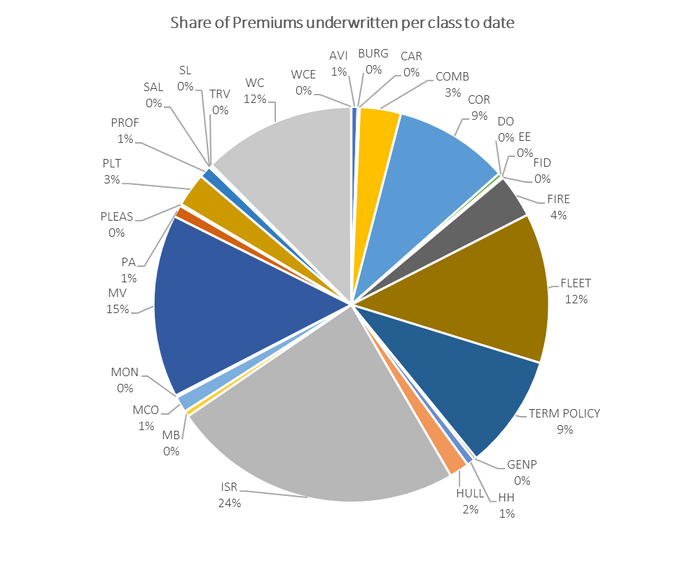

The Top Five (5) classes by total Premiums Written to date are:

- Motor Vehicle (MV + FLEET combined)

- Industrial Special Risk (ISR)

- Workers’ Compensation (WC)

- Term Policy (combined medical + term policy)

- Contractors All Risk (COR)

The Top Five (5) classes by Claims Paid to date are:

- Motor Vehicle (MV + FLEET combined)

- Industrial Special Risk (ISR)

- Fire (Fire)

- Medical, Accident & Term Policy (Term Policy)

- Workers’ Compensation (WC)